The index measuring the perception of the current economic situation slipped to 51.8 in April from 60.0 in March, and confidence in expectations for the next six months fell to 75.9 from 86.2. Employment expectations fell to to 48.5 from 57.5 last month.

'In April, sentiment data fell again mainly due to drops in the components that relate to the Spanish economy and employment,' ICO said. 'The drop seems to point to a faster deceleration in family consumption than was expected at the beginning of 2008...and is in line with forecast cuts for Spain's GDP and private consumption growth.'

PNB Paribas in a research report out today note that:

Household confidence collapsed further in Spain, falling 9.3 points over a month and 30.6 points over a year to 63.8 in April according to ICO. This is the lowest level ever, but the index only started in September 2004. The fact that the absolute level is way below the neutral threshold of 100 is more meaningful.

This is not a real surprise given most indicators are plunging in Spain. The soaring prices and rising unemployment naturally weigh on household confidence. Today's data also confirmed that house prices are on the decline, which can only make things worse for this country. The pace of the decline registered in April is quick, which darkens the outlook for Q2 growth, making unlikely the fact that the 0.4% q/q growth registered in Q1 would be repeated in Q2, as we said last week.

This general picture is also confirmed by the April reading on the European Commission’s eurozone “economic sentiment” index which fell sharply from 99.6 in March to 97.1 in April – the lowest level since August 2005. With the indicator regarded as good guide to growth trends, the unexpectedly steep decline pointed to a marked deceleration in economic activity.

Still, eurozone countries show varying performances. Economic sentiment in Spain, which is at risk of a serious house price correction, has fallen to the lowest level since late 1993. But sentiment in Germany and France remains relatively robust – falling to the lowest levels since February 2006 and December 2005 respectively.

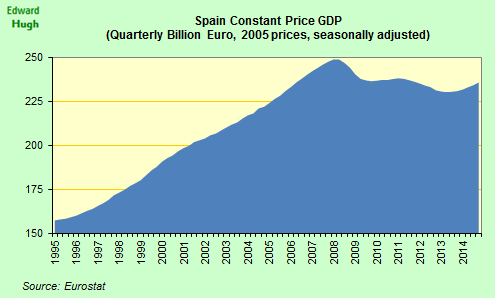

As can be seen from the above chart, Italy continues - like Venice - its steady downward drift, while the two eurozone economies which had the strongest housing booms head steadilyoff the cliff, with Spain having poll position, and by quite a long margin.

If we look back to the previous ICO consumer confidence charts we can see really that the downward process slowed in February March - coincidentally or not this was the election period - but the downward fall in expectations has now taken an additional lurch entering April. This coincidees with the general idea that the problems in the financial and construction sectors - which have to some extent had a torniquet applied to them by action at the ECB (in accepting cedulas) and by the continuing acceptance by the banking sector of the builders growing indebtedness - are now slowly but steadily (rather like an oil slick in the ocean) extending their way across and into the real economy.

This picture is also confirmed by the most recent employment data and by the April manufacturing PMI (see seperate posts).

No comments:

Post a Comment