Firstly, Eddy makes a very valid point about the 3 month Euribor level and the impact of variable interest rates on Spanish mortgage holders:

"most spanish mortgages (>90%?) are variable, and referenced to 1 year Euribor, so the 3-month euribor/libor "crunch" is inmaterial for setting interests rates. (1 year Euribor has barely moved through the "troubles")."

Now what Eddy says is certainly the case (although we are still unsure about the exact percentage of mortgage holders who have variable rates, the number is undoubtedly very high), but Eddy's key point here is that the recent incrtease in the 3 month Euribor (and Libor euro) rates is not being passed directly on to the banks' consumers, since they are tied to the one year rate, and that hasn't really moved up much. This is a factor I hadn't previously thought about. Basically I hadn't picked up the one-year part of the story, I suppose because I hadn't been paying attention sufficiently to the details here. (this is just one good example of how useful blogs are, since they enable you to contrast opinions quickly in real time).

So the squeeze on the inter-bank rates won't hit the mortgage holder directly, but it will hit someone, somewhere, and the most likely candidtaes are the Spanish banks, since it is the banks themselves who are paying these new, higher, rates to finance their day to day operations. BBV is now offering 4.5% on 12 month fixed term deposits, and 3.8% on two year fixed term deposits, so the short term need for cash is to some extent inverting the yield curve already.

This I suppose helps explain the volume of money Trichet and Co at the ECB recently poured into the banking system system. The ECB - you will recall - supplied €348.6bn to banks in its two-week operation on 18 December - at a rate of 4.21 per cent - after scrapping the normal upper limit on the amount it would lend.This was in part to try and ease the pressure which must be mounting on the Spanish banks (and others, of course, but the Spanish banks must be among the most exposed at this point, see below). While the British Chancellor of the Exchequer Alistair Darling announced a four point plan this week to protect UK citizens' deposits in threatened banks, the Spanish authorities remain strangely silent at this point. Their failure to be able to reassure in the form of concrete guarantees is perhaps more worrying than were they to talk openly about the problems.

I don't have any real data on the banking sector in Spain, but it is this sector which seems to be the key area in the whole Spanish story (as I try to argue in this post, the real economy in Spain is now giving a lot of signs of slowing at a very rapid rate). Most authorities (eg the Bank of Spain) are busy denying there are any issues, but I don't really see how there can't be. Essentially if they are charging "x" base points over one year Euribor, while they are financing with three month rollovers, and now they have to pay more for the three months finance (once the ECB's 3.21 "xmas present" comes to an end, then their operating margins have just received a big squeeze.

Essentially it would be interesting to know the proportion of mortgage lending in the 2004 - 2007 period which was taking place on the basis of "own bank deposits", and how much of the financing was being outsourced by the banks. This measure would give us some sort of vulnerability indicator for the Spanish banking sector. Basically, taking Eddy's point about euribor - this net effect of this is to insulate the borrowers (which was not really the original intention, I am sure), and pass all the additional costs onto the banks, since they need to keep rolling-over borrowing on a three month basis (or to some significant extent they do). So their margins and liquidity must be being squeezed at this point. We will see how long they are able to accept the pain before someone says "ouch".

My guess is that Spain must have one of the highest quotas of home grown sub-prime problems (ie not derivatives from the US situation) on the globe. These principal sub-prime issues are likely to come in 2 areas: a) second-home owners from outside Spain - who have been very numerous in areas like Almeria and Valencia. Basically if property prices tank at some point in Spain, and the debt of many of these "investors" exceeds the evident long term value of the underlying asset then they amy well decide that the rational thing to do is accept the capital loss of their initial payment, and simply walk away from underneath, leaving the keys with the bank as they go, as we ahve seen in the United States; b) and secondly, we have the immigrants. As I show in the chart below, inward migration to Spain in recent years has been very substantial (perhaps proportionately the highest level of any country on the globe).

Here in Barcelona where I live we have whole "barrios" - like, for example, Santa Coloma de Grammanet - where the locals basically sold their homes in what were traditionally poor areas and moved to larger and relatively cheaper properties in housing estates outside Barcelona (Olesa de Montserrat, for example, seems to have been popular in the case of Santa Coloma, Spanish consumer behaviour is very much of this nature, with people tending to look at what others are doing and folloing trends). So basically places like Santa Coloma now have a very significant immigrant population, and many of these family groups have bought property and have outstanding mortgages . Immigrants tend to be badly paid, but they do work long hours, and they do save, and at the height of the boom Spanish banks were accepting four or five "nominas" (or paychecks) as backing for a single mortgage, for a small interest premium, of course (but isn't this the heart of "sub-prime"), and a lot of migrants have bought-in. It is precisely this group who will be the first to feel the impact on the real economy, and then it is difficult to see how they will be able to maintain payments. And again, in extremis, many migrants can simply walk (as Eddy suggests in his comment) either by going to another EU country, or moving back home.

Young Spanish people represent less of a risk to the banks, since - as former Govneror of the Bank of Spain Jaime Caruana cynically noted when accepting that property prices in Spain may be over-valued by as much as 35% -they are basically linked in to the banking system through the DNI cards and paycheck link-ups, and it it is thus very hard for them to just walk away. The only thing such young people could realistically do is emigrate, and again as Caruana noted there is very little tradition of this in Spain (even Spanish migrants to Latin America in the first part of the 20th century had a very high return rate) due to family ties etc. So this group of people will be faced with significant distress, and their consumption patterns will be affected, but they are relatively unlikely to simply default.

Essentially what we can see at the moment is that the whole property sector is seized up, and it is likely to remain this way for many years to come. This seize up is being produced by what is known as a change in the "lending conditions", and this change has much greater importance than any simple and straight forward interest rate effect. What do I mean by a change in the lending conditions? Well banks were previously lending to people in Spain over 50 year terms, with offers of interest-only payments for the first 3 years, and, most importantly, with loans of 100% (or even 110%) of the "banks own" property valuation.

Such days are now well over, and they are gone permanently. Basically it may have made sense to someone to lend to the tune of 110% of an underlying asset when the value of this asset was rising by 20% a year, but now that no one knows for certain the future path of the asset value, and when most rational people accept that the direction of any movement is far more likely to be down than up, then noone wants to know anything about such forms of lending. This type of "financial efficiency" is now well and truly dead.

Banks now won't shift above 80% of the (much more strictly measured) estimated value, so this means that young people need to find a minimum of 20% of the asking price, plus notary fees and furniture. So if we take a bottom level entry flat for a first time buyer in a major urban area to be, say, 300,000 euros, they these young people now need to find 60,000 euros plus expenses. Maybe 100,000 euros in total. And they have very little savings, since in the past these weren't considered to be necessary (the behavioural shift).

Worse, mummy and daddy don't have savings either, since the low interest rate environemnt encouraged them to take their savings out of deposit accounts and sink them in second homes. So for the children to buy the parents now need to sell one of their properties, and this is one of the first points were we will surely see downward pressure on prices, since someone somewhere has to unlock something in the was of frozen liquidity for the current gridlock to "unseize" itself. Also the children will need to start to save that 60,000 plus, so immediate consumption will also be affected, as possibly this impact is already being felt.

A second factor which is going to seize up the works is the behavioural shift which is taking place from buying first and selling second, to selling first and then buying. Most people who bought new properties in recent years in order to move "up market" from their existing home bought on the basis of architect's plans (which is why construction is still ticking over, since all the property that was bought up to August still has to be built), and only selling their current home at the last minute. This made sense while prices were rising, but now they are falling.....

I think it is important to realise just how much in the avant-guard the Spanish banking sector were in introducing the so-called "financial efficiencies" which made the boom possible. Now some of the "efficiencies" achieved are real and permanent (like some of the benefits of financial globalisation, you can borrow cheap in yen, eg), but some - like raising the % of the loan, lending to risky individuals, lending on the basis of issuing paper rather than deposits - were most definitely not efficiencies, but "irrational exuberance". As I say, the Spanish banks - especially BBV, Santander Hispano, Sabadell Atlantico - seem to have been in the forefront of all this. My feeling is that the caixes have been rather more conservative (at least here in Catalonia) but that may vary from region to region (and remember many regional cajas are involved with local political institutions who may now be seeing property-boom-related income drying up, and hence some of the institutional indebtedness they have on their books may now become unsustainable. I would also be thinking about corporate balance sheets, if the value of the urban office "park" starts to fall, some of the major companies may be widly over-leveraged in this context (think of all the euphoria at the time of E-On/Endesa, and all those warning from the ECB about excessive leverage).

One measure of the issues raised by financial globalisation can be obtained by looking at the contributions to a recent Bank for International settlements conference on the topic (2006) Basically the whole conference is interesting, but in particular the Panel on "Review of recent trends and issues in financial sector globalisation" session and in especially the presentations from Christine Cumming (Federal Reserve Bank of New York), José Luis de Mora (Banco Santander Central Hispano) and David Llewellyn (Loughborough University) are of interest. De Mora is fascinating, since he gives us an indication of just how the Spanish banks were taking their new "methodology" to the UK (think Northern Rock).

Basically one part of my work as a macroeconomist is related to the role of demographic processes and construction booms. Especially I have been following Germany, Japan and Italy, since these are the oldest societies that have been produced to date, and they seem to have quite distinct characteristics when it comes to domestic consumption dynamics and property sector activity in recent years as compared to their younger counterparts. My feeling is the nearest comparison we have to what just happened in Spain is Japan 1992. Especially given that the move into property in Japan post the 1989 stock market bubble crash and the post internet boom collapse move into property in Spain. The most worrying aspect about what is happening at the moment is undoubtedly the recent sharp spike in inflation. With the real economy near to entering constraction, and demand falling all over the place this inflation simply cannot be sustained, so Spain does have, IMHO and especially given the lack of a sensitive interest rate policy from the ECB, a real risk of turning itself completely upside down, and falling into Japan style deflation in the mid term. This is something which I never would have imagined possible only a year or so ago, but you need to look at the continuous above-trend growth in prices we have seen in Spain over the last six or seven years, and think about how an economy can correct for these in a common currency zone, and especially with global factors (the fall in the dollar, the disintegration of Bretton Woods II) maintaining the euro at possibly very high levels. Structurally the eurosystem was never designed with the need to operate a country specific ZIRP ( zero interest, massive liquidity easing) policy, but that is exactly what may be needed in Spain if the worst case scenario is fulfilled.

Demographic factors are important here. Basically the 25 to 50 age group just peaked in Spain (see chart below), as it did in Germany in 1995. This means that natural demand for housing, and home loans, is likely to trend down from here on in. The only unknown is immigration. Spain just sent its estimates for 2007 migration in to Eurostat (and they must have a pretty good idea from the Padron Municipal) and we have yet again had a record year it seems, with the estimate pushing the 700,000 mark (again see chart). But the big question is what is going to happen to all these people during the downturn.

In conclusion I would say I have three large questions in my head:

1/ What happens to the immigrants and inward migration?

2/ What level of distress will we see in the banking sector going forward?

3/ What will happen to all these young people who are mortgaged up to their eyeballs on property whose value may now enter a protracted period of secular decline. Will there be political pressure in Spain - as in the US - for the situation to be eased (possibly by adjusting downwards the book value of the debt). If any such political measure is taken, who will pay the bill? Basically Spain's "broken plates" will need to be paid for by some apportionment between the young people themselves, the banks, and the taxpayer, but the big question is in what proportions?

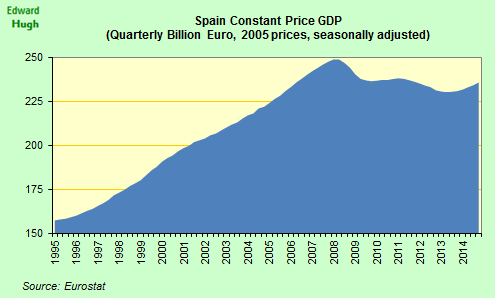

I don't anticipate that this is going to be a short term affair at all. Everything got a very heavy push start back on 9 August, we are now in January, and things have hardly started to happen. If we go back to Spain's last real recession - foolowing the 1992 "Olympic" boom, see chart below - then property prices needed till at least 1995 to recover their earlier values. This time I think the situation is much, much more serious. Japan really still isn't out of the problem that started in 1992 even now. So I would say a conservative estimate on this one is a five to ten year window of problems, and that is imagining we get a "soft" landing, which may well not be the case.

So basically, while I don't have time to comment on Spain's issues on a day by day basis, I will try a more or less monthly report on this blog as new data comes in.

Well, if you've got this far, the above is a summary of my original comment, and now here is Eddie's most revealing reply:

1/ What happens to the immigrants and inward migration?

"Many immigrants will lose their jobs (construction, services etc). This is already happening. Many will return home or will seek greener pastures in Europe. "

"See for example here

"Page 22-Foreign unemployed total increased by 24,5% y/y

Foreign unemployed in construction increased by 53.5% y/y "

2/ What level of distress will we see in the banking sector going forward?

Although data is disperse, my hunch is that the problems for the financial sector will come short term from the immigrants (where a lot of shoddy financing has been going on, without adequate income history) AND the R.E. firms, who are clearly overexposed.

But the main threat for the banking sector short term IMO, is not an increase in delinquencies but the inability to roll over their debts in the European Inter bank Market or to sell their mortgages (cédulas) abroad at all, or at least, to do it in profitable terms.

Margins for the Spanish banks in their mortgages are razor thin. A typical mortgage with Euribor 1Year +0,50% is paying now around 5,25%.

(There is a market failure here, cause they are using short term rates to finance long term credits, with a very low margin, anyway, great for borrowers)

A flattening of the curve is causing clearly pain for the banks (and they have convinced a lot of clients to sell their “fondos de inversion” and transfer the money to deposits as a short term remedy)

In the same manner as thecrash in US mortgage providers, Spanish banks could very well be soon unable to sell the mortgages they originate, or roll over the existing debts.

A la Northern Rock, but much, much bigger.

This would be a text book “sudden stop” in external financing …and with a 10% c.a. deficit this year, something to worry A LOT.

3/ What will happen to all these young people who are mortgaged up to their eyeballs on property whose value may now enter a protracted period of secular decline.

For me the main problem now is not “negative equity” , but the effects in general activity of a housing recession. Of course a lot of people will become house-slaves (unable to sell or to move away). But barring any financial accident, the could cope with their debts if Mr Trichet doesn’t increase rates.The problems will come later, with a general recession (given the oversize weight of housing in Spain’s economy), unemployment etc. Of course a general recession would decimate public finances

4) Variable/Fixed Mortgages

Well, I don’t have the total numbers, but my hunch is that 90+% of the mortgages originated in the last 10 years are variably type.

Take the numbers for last month, for example here ( October 2007)-97,6 % of mortgages where variable (incidentally, notice the fall in total volume for residential –7.32% y/y and –5,67% m/m)

Now in response to the following comment from Eddy:

"The problems will come later, with a general recession (given the oversize weight of housing in Spain’s economy), unemployment etc. Of course a general recession would decimate public finances"

I reply:

Yes, but if you look at the data I am presenting, we may be heading for recession quite - indeed alarmingly - quickly. There was already some indication of a slow-down in the third quarter. The quarter on quarter increase was 0.7% which was down from 0.9% in quarter two. More significantly perhaps was the fact that the slowdown was lead by a deceleration in domestic demand, while the quarterly growth did not fall more due to the fact that exports increased significantly, so external trade became less of a drag.

When we come to the fourth quarter we should expect this downward trend in domestic consumption to be continued, and this is exactly what we are seeing, first and foremost in the case of retail sales,which are now steadily going down month by month.

At the same time construction is weakening steadily, industrial output started to contract in December (going by the PMI) and the services sector is now barely growing. Given that foreign trade is a still a drag rather than a boon, my guess is that the Spanish economy will enter negative growth in the 1st quarter of 2008, and that it will stay there for some time. As we can see from the chart below, private domestic consumption (in terms of year on year growth rates) actually peaked back in 2004/5, and the rates of increase have been slowing all the time since - as the last drops of juice get gradually squeezed out of the lemon - so we should only expect this trend to continue:

And if we come to look at the quarter on quarter changes for the last seven quarters, then I think the trend is very clear - for my taste at least. In Q3 2007 private domestic consumption only grew at 0.37% over Q2, we have to go back to Q1 2003 to get a slower rate, and if we look at 2006 and note the rebound there was in that year, then we should ask ourselves about the difference in global conditions in end 2006/early 2007 and then I think the position should be clear enough.

If we now come to look at the long term charts for Spanish GDP, we can see that there hasn't been anything approaching a recession since in Spain since 1993, and we should be asking ourselves why that is. Oh, I know, Spain is different, but it really can't be so different that it can simply ignore all the laws and rules of marcoeconomics. Basically I think the answer is simple enough. In priciple Spain ought to have had a recession in 2002 along with virtually everyone else, but cheap interest from the ECB kept putting it off and off. I mean I think it is important to note that Spain hasn't even had one single quarter of negative growth (on a seasonally adjusted basis) since the 1992/93 recession. So now we should expect downside underperformance to follow all the upside overperformance. That is what my macro instincts tell me.

As can be seen from the combination of charts (which overlap slightly since they are based on different time series) not only has Spain not had a recession since 1993, it has not had even one quarter of negative GDP growth (on a seasonally corrected basis, remember there is Spain's "other" dependence, apart from construction that is, the dependence on tourism).

Now if we look at the first chart (which shows annual rates of change by quarter, while the second shows quarter on quarter change), we can note the importance of the Nasdaq correction at the end of the internet boom, since there is a marked slowdown in the rate of annual growth, but there is no recession - I think this is the key point I want to make here - and there is no recession since construction activity took over from the stock market, as the money moved over from one "bubble" to the other (just like Japan in 1989 and 1992).

All of this can be seen from looking at a chart for monthly cement construction since the late 1990s which simply goes up and up.

Cement output serves as a nice proxy for the levels of construction activity (which puts a whole new meaning onto the old expression about getting "stitched up in a concrete overcoat") and as we can see the level of this activity has yet to fall in any substantial way - due I suspect to an uptick in government civil engineering activity, as well as the completion of outsanding purchases. Yet Spain's economy is already slowing very noticeably . we can just see it in the way GDP starts to point down in Q3 2007 (at the very end of the upper graph), we should expect to see more of the same in Q4, and then I conjecture real negative territory in Q1 2008. I may be out by a quarter here (ie negative growth may come in Q2, but I doubt the margin of error is greater than that). So the present slowdown is more the result of movement in the financial services and real estate sectors than in construction itself. Which means, of course, that there is a lot more to come as construction activity itself starts to decline.

If you want to know the size of the correction the Spanish construction industry has to make, then just look at the cement production increase since the late 1990s - from roughly 2,500 thousand tonnes monthly to around 5000 thousand tonnes, or the double. That is how far back we need to unwind I think.

Some additional indication that the process has barely started can be gained from the next chart, which shows the progression of buildings approved for construction since 1992 on a monthly basis. This series appears to have spiked at a local peak in the summer of 2006, made a temporary resurgence towards the summer of 2007, and now started to head down. The latest month for which we have data here is September 2007, but all the evidence points to the fact the decline continued across the last quarter.

Another interesting measure of the extent of the problem comes from thinking about the share construction activity has come to assume in Spanish GDP. As we can see from the next chart this share has risen from around 70% in the mid 1990s to 11.5% in the last two quarters of 2006. Logically it is now about to trend down again, leaving us with the question of what can come online to fill the gap. My own view is that ultimately Latin America will be the salvation of Spain, but this will mean transforming Spain from an internal consumption driven economy to an export oriented (possibly services dominated?) economy along the German lines. But the road from one thing to the other is likely to be a long and hard one, and there lying in the middle is the question of what to do about the extraordinary indebtedness of the under 40 generation in Spain.

The next chart gives us some indication of the extent of the house price rise. I say some indication, since it is simply Eurostat's housing cost component for the harmonised CPI, which is not a dircet measure of house prices, but does give us an idea of the relative order of magnitude. By way of comparison I have included the data for Germany over the same period, and this should lead us to ask why - given the same interest rate was applied in Spain as in Germany - Spanish costs rose so much more rapidly. Oh, I know, because inflation expectations were so much stronger in Spain. But this argument is in danger of becoming circular, since why were expectations so much stronger in Spain than they were in Germany?

The next chart shows movement in quarterly house prices themselves (for both new and second hand properties) since 1995 using the data prepared by the Spanish housing ministry.

As can be clearly seen, the most important part of the boom was between the end of 2001 and the middle of 2006. An what was happening during that time? Well just to remind us I am reproducing the chart for spanish inflation and ECB interest rates that I prepared from my last post. As is pretty evident, the height of the boom coincides pretty closely with the period during which Spain has negative interest rates.

The next graph shows the net migration annual figure for Spain in recent years using data provided by the INE to Eurostat. Of particular interest I feel is the number of migrants still ariving in Spain in 2007, despite the first signs of slowdown. This is definitely a key data number to watch going forward.

Finally here are two additional demographic charts. Firstly the fertility data for Spain, since this gives us an idea of the longer term native domestic demand for housing.

And lastly, the chart for the 25 to 49 age group as a proportion of the total population. As we can see this group peaked in 2006, at around what ar far as I can see the highest proportion for any society yet to date of 40%. Is this just a coincidence, or does it have more significance in all this?

No comments:

Post a Comment